VALLETTA (MALTA) (ITALPRESS/MNA) – Malta will raise the effective tax rate for large multinational companies from 5% to 15%, Prime Minister Robert Abela announced.

The decision, approved by Cabinet last week, will affect around 10 companies based in Malta with annual global turnovers above €750 million. It brings the country in line with the European Union’s global minimum tax framework for multinationals.

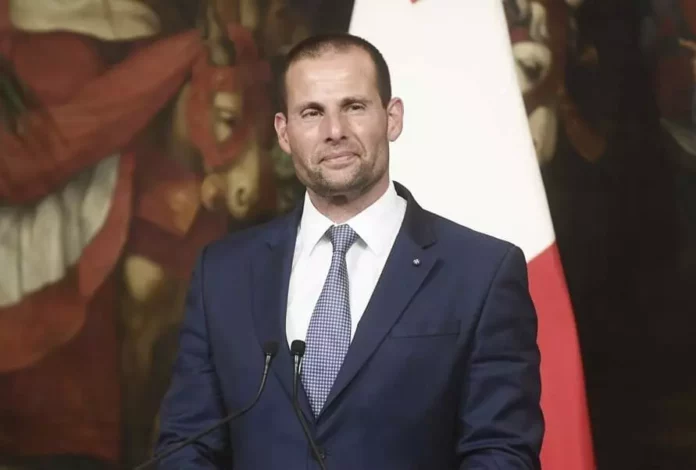

“This decision we took in Cabinet this week will ensure that these companies pay their full tax liability in Malta rather than having it collected by other countries,” Abela said in an interview on ONE TV. “This means Malta will collect substantial new revenue that we can reinvest in our social programmes and infrastructure.”

The move reverses a previous government decision to delay implementation of the EU directive by six years. The legal notice transposing the directive into Maltese law was issued in February 2024, but Malta had exercised its right to postpone enforcement.

By opting to apply the measure now, the government expects to secure significantly higher tax revenue, strengthening public finances while aligning Malta with international standards on corporate taxation.

-Photo IPA Agency-

(ITALPRESS).